A simple way to evaluate blockchains

Cutting through the noise

Layer 1s. Layers 2s. Sidechains. Rollups.

Web3 is full of jargon, so let’s first set the stage and offer an easy way to think about the space.

If you’ve scrolled through crypto-Twitter, you’ve likely heard people mention layer 1s (L1s) like Bitcoin / Ethereum and layer 2s (L2s) like Arbitrum / Optimism. If you’ve listened a little more closely, you’ve likely heard people mention sidechains like Polygon PoS and rollups like StarkNet. If you are further down the rabbit hole, you likely know that there are many other flavors.

However, for this article, we are going to ignore all of that.

Instead, we are going to simply think about each solution as a blockchain. Whether or not L2s and rollups are technically blockchains is an esoteric topic and up for debate, but it’s useful to think about them this way.

Evaluating blockchains

Now that we have a bunch of blockchains - which ones are the best?

Each blockchain can be evaluated based on different properties. Here are the major ones:

Performance

Cost

Security

Decentralization

Let’s unpack them through a non-technical, end-user lens.

Performance refers to both bandwidth and throughput - how many transactions the blockchain can process at once and the speed at which they are processed. This is analogous to how many lanes a highway has (bandwidth) and what the speed limit is (throughput). As far as an end-user is concerned, performance is how fast the application runs - whether the application is sending someone money, trading one asset for another, or posting tweets on web3 Twitter.

Cost is pretty straightforward - it’s how much the end-user must pay in blockchain fees to use the application.

Performance and cost are sexy to talk about and make all the headlines.

“New supersonic L1 raises $1 billion with 1 billion TPS and 0 fees!”

In turn, many people entering the web3 space place a disproportionately large value on these two properties. Sometimes people only consider one of the two - simply looking at one blockchain as cheap and another as expensive. In fairness, this is how most of us are accustomed to evaluating technology products, but with blockchain there is more to it.

The other two properties are security and decentralization.

Security can be confusing since people use it to mean all different things and you commonly see blockchain experts talk right past each other when discussing it. In this Twitter thread, Polynya does a good job breaking security down into three components. Two are quite hard to build:

Economic security: In proof-of-stake blockchains, if a user owns the majority of “staked” coins, they get meaningful control over the network. Since the system relies on coins accruing value (the more expensive the coins, the harder it is to buy the majority of them) it is important for blockchains to have a sound monetary policy and build up their currency’s credibility over time.

Protocol stability: Protocols are implemented in software and software carries the risk of bugs. In software development, there are best practices to minimize bugs such as keeping the software simple (fewer lines of code means less room for error) and keeping upgrade processes conservative (more time for testing). Examples in a blockchain context include protocols deciding not to add functionality for on-chain governance and taking longer to upgrade as the total value locked (TVL) grows.

Decentralization is hotly debated, and like security, it can mean a lot of things.

Balaji wrote a comprehensive article on the topic, breaking blockchains down into subsystems. However, he does acknowledge that “some of these decentralized subsystems may be more essential than others” and for simplicity, we will just focus on nodes and ownership. Polynya also wrote an article highlighting these two critical aspects.

Node decentralization: How easy is it for the average person to run the blockchain software (to become a network “node” and verify transactions) and how many people are actually doing it? If you run a node, no one can change the protocol rules on you because your computer will reject invalid transactions. If the software can run in the background on a laptop or phone, more people will run it (it could even come integrated with devices) If the software requires an expensive server in the cloud, fewer people will run it.

Ownership decentralization: Earlier we said that in proof-of-stake blockchains if one person has the majority of staked coins, they get meaningful control over the network. It would not be good if one person or a few parties had even close to the majority of staked coins, so it’s important for tokens to be widely distributed.

A few examples

Now that we know the evaluation criteria, we can look at examples.

Solana: Great at performance and cost

Ethereum: Great at security and decentralization

StarkNet: Great at performance, cost, security and decentralization

Solana has developed a strong brand around speed - and it lives up to the hype. When using Solana you feel like you are using a typical web2 application. You still must pay transaction fees, of course, but they are negligible.

The downside is this is accomplished by requiring very powerful and expensive computers to run nodes (causes poor decentralization over time) and unsustainable token economics to subsidize the cost of running nodes (causes poor security over time). Solana also still has suboptimal token distribution and protocol stability as a two-year-old project.

Ethereum makes the opposite tradeoffs. It is by far the most secure programmable blockchain - both in its current proof-of-work form and the soon-to-be proof-of-stake form. There is currently ~$23 billion staked of ether, its sound monetary asset, and the protocol has proven stable over the past six years. Ethereum also maintains low hardware requirements to run nodes and a culture that promotes the behavior.

The downside is that scarce, desirable blockspace causes congestion and high transaction fees, dramatically limiting the types of applications and users that can leverage the network. For the past few years, Ethereum has worked well for high-value / low-throughput use cases like financial services but horribly for low-value / high-throughput use cases like social media.

Are both sets of tradeoffs viable?

It’s unlikely. Chains that neglect security and decentralization will be unsustainable over the medium-long term - a view backed by basic economics and predictable hardware projections.

Enter rollups!

StarkNet, and other rollups (blockchains) like it, solve this problem and unlock the best of both worlds. The way they do this is by focusing on performance and cost while using fancy cryptography to inherit security and decentralization from another blockchain.

We won’t get into how rollups technically work, but rather hammer home the benefits. If you are using applications built on StarkNet, you are benefiting from the security and decentralization properties of Ethereum behind the scenes. As an example, even if the StarkNet operators are corrupt, it is mathematically impossible for them to steal your funds unless they also corrupt the Ethereum network.

Because of the cryptographic assurances, rollups can focus their energy on optimizing performance and cost to support high-value and low-value applications alike. As a relatable example, developers can fork Solana and tweak it to be an Ethereum rollup. Better yet, a bunch of developers can deploy a bunch of Solanas, all running in parallel and inheriting Ethereum security and decentralization.

Circling back to StarkNet - developers can also design rollups from the ground up to be faster and cheaper than Solana, which is of course what many are doing. The design space is wide open!

What gives?

It’s likely you are now thinking to yourself: “That sounds great, but what’s the catch? Solana pops up everywhere and this is my first time hearing about StarkNet. Why would people choose inferior solutions?”

The reality is it’s early days for most rollups and it only became vogue to build them over the past couple of years. Before that, VCs were more inclined to fund “Ethereum killers” than solutions building on Ethereum. Even Polygon, which has committed $1 billion to rollup development, had to somewhat embrace the competing L1 narrative to get off the ground.

Even more important to point out is that the magic behind rollups is based on state-of-the-art cryptography. It’s hard moon math and takes longer to deploy than simply copying the code of existing blockchains.

Despite the above challenges, some rollups are live with training wheels on (e.g. centralized sequencers) and others are around the corner.

Early signal

Developers and users can’t be expected to sit still, so naturally, applications and supporting infrastructure (e.g. wallets and fiat on-ramps) are built around available solutions. Fortunately, some rollups are compatible with existing blockchains, making it easy for developers to port apps. In the same way it is trivial to move from Ethereum to Avalanche, it will be trivial to move from Avalanche to EVM rollups as they mature.

So, do any rollups have traction today?

Yes! Quite a few, actually. For example:

dYdX has ~$1 billion of TVL in its decentralized exchange rollup.

Immutable X, an NFT-specific rollup, is working with some impressive names like Mastercard and Gamestop, which is building an NFT marketplace.

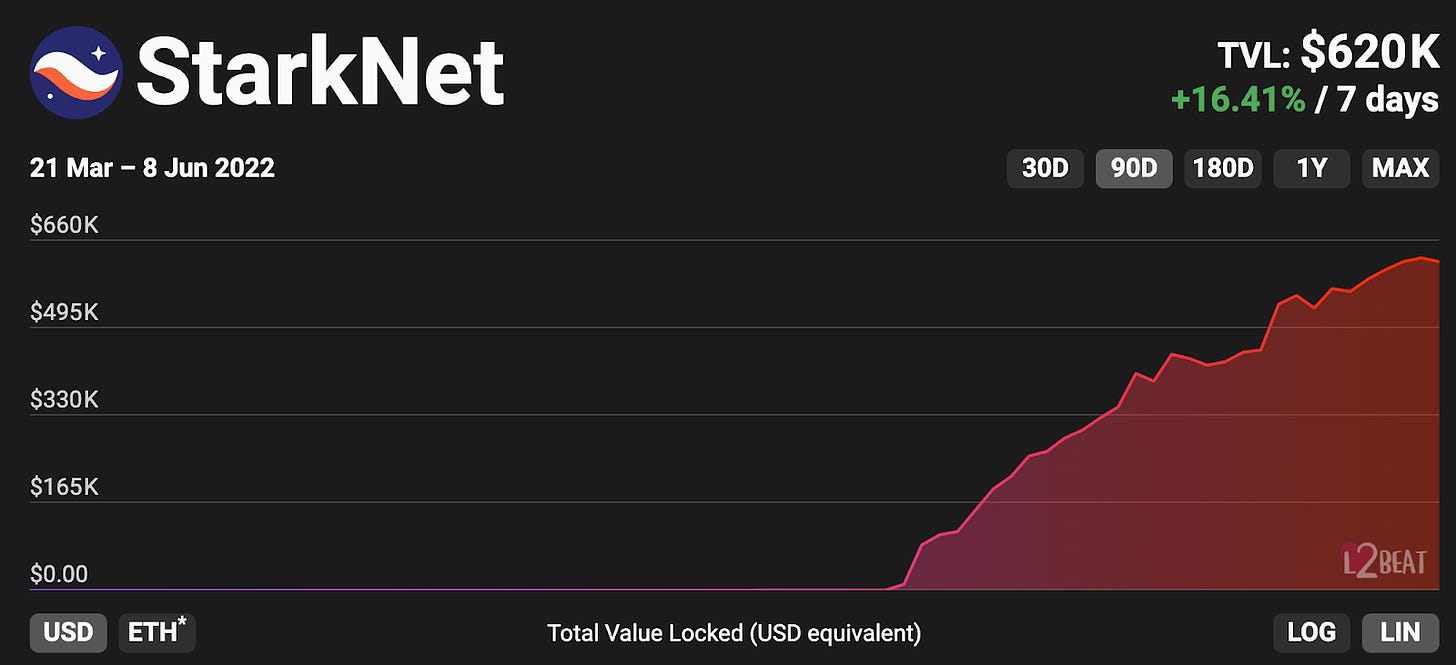

StarkNet recently launched their alpha product on Ethereum mainnet, which already shows impressive adoption.

If the early activity is any indication, the future looks bright for rollups.

Why it matters

The need for strong security and decentralization is intuitive when dealing with valuable assets, but less so when playing games or scrolling through social media feeds.

When you recognize the connection to application sustainability over the medium-long term, it starts to make more sense. If you knew that social media platform A would be going out of business in 2-3 years and social media platform B would last decades, you would likely start posting and building your reputation on social media platform B.

Hopefully this article helps guide your thinking, whether you are looking to build or use blockchain applications.